There is an undeniable trend in UK markets for takeovers of listed companies, and it is easy to see why. Of the roughly 800 UK stocks with a positive EBITDA, the median EV/EBITDA is 10 versus 15 for the 3000 such companies in the US market. There are some fundamental reasons for this mismatch in valuation.

Pension Fund Flows

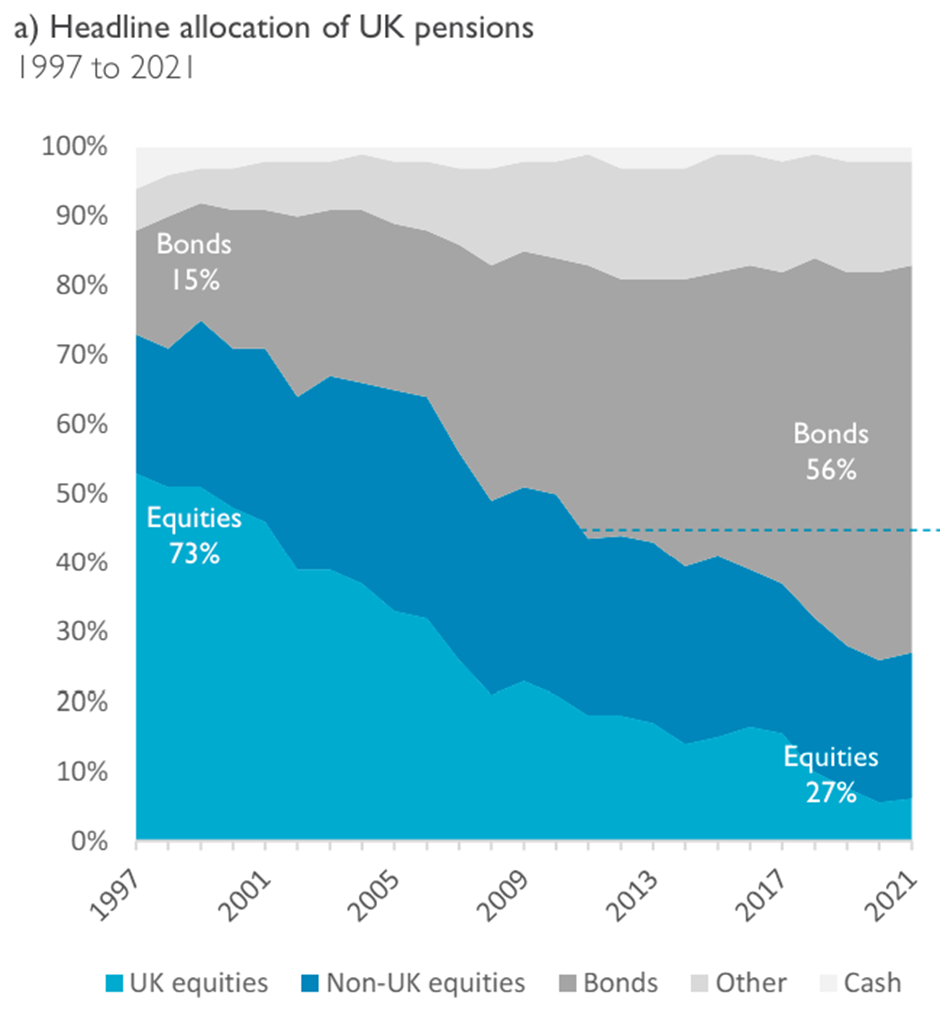

One of the biggest reasons for this disparity is a dramatic shift away from UK Equities being owned by UK Pension funds. The Capital Markets Industry Taskforce (CMIT) reports that this is due to two trends. Firstly, UK pension funds have shifted away from owning equities into bonds, as this chart from CMIT shows:

This is primarily because Defined Benefit pension funds, almost all of which are now closed to further accrual, have been de-risking, which involves selling equities and buying bonds.

Secondly, pension funds have increasingly been given a global mandate when investing in all assets, including equities. Defined contribution schemes, which are now the norm, tend to offer their members global trackers rather than UK trackers. This makes logical sense for clients. However, the knock-on impact on UK equity allocation is stark. With the proportion of assets invested in non-UK equities remaining reasonably constant, the shift to bonds has almost entirely come at the cost of UK equity allocation. This has dropped from over 50% in 1997 to around 6% in 2021. Such a shift cannot occur without impacting valuations.

Retail Fund Flows

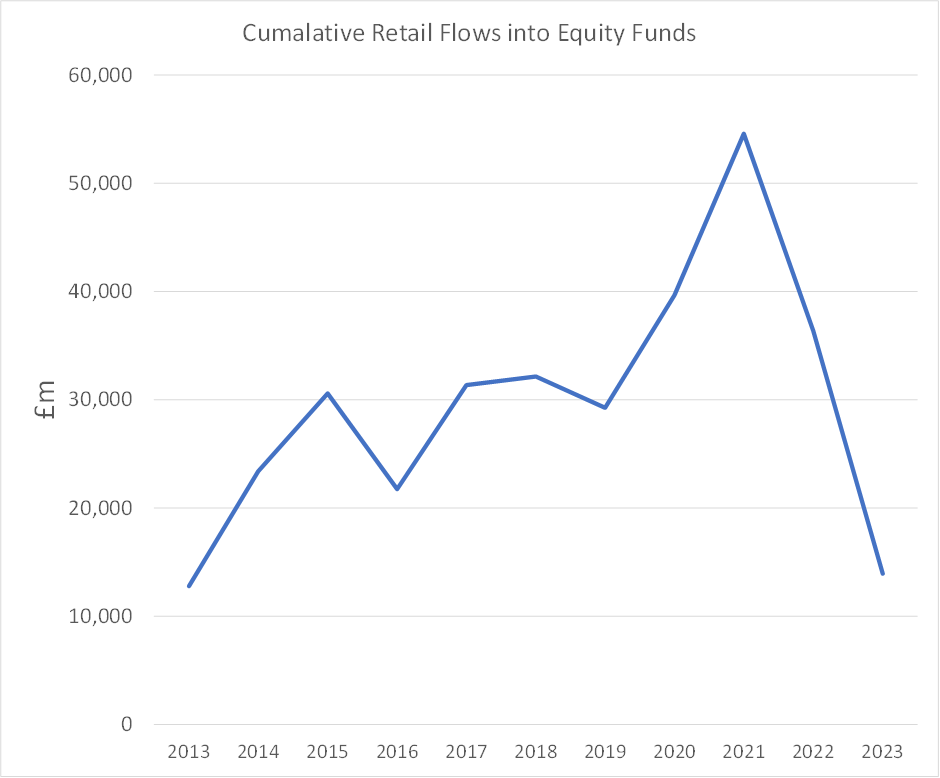

With pension funds net sellers over the last few decades, the record of retail investors taking up the slack is mixed. Unfortunately, we are a flighty bunch. Here are the cumulative retail flows to UK equity funds over the last decade from The Investment Association:

These rose significantly between 2013 and 2015 and again in 2020 and 2021. However, 2022 and 2023 have been terrible and given back almost all the cumulative inflows over the previous decade. The data so far for 2024 isn't looking any better, with £1.8bn of outflows in January & February.

Part of this may be the logical response to pension funds' selling. No one wants to step in front of a freight train. However, this has been a multidecade trend that didn't stop retail inflows into equity funds a few years ago. The recent net outflows…